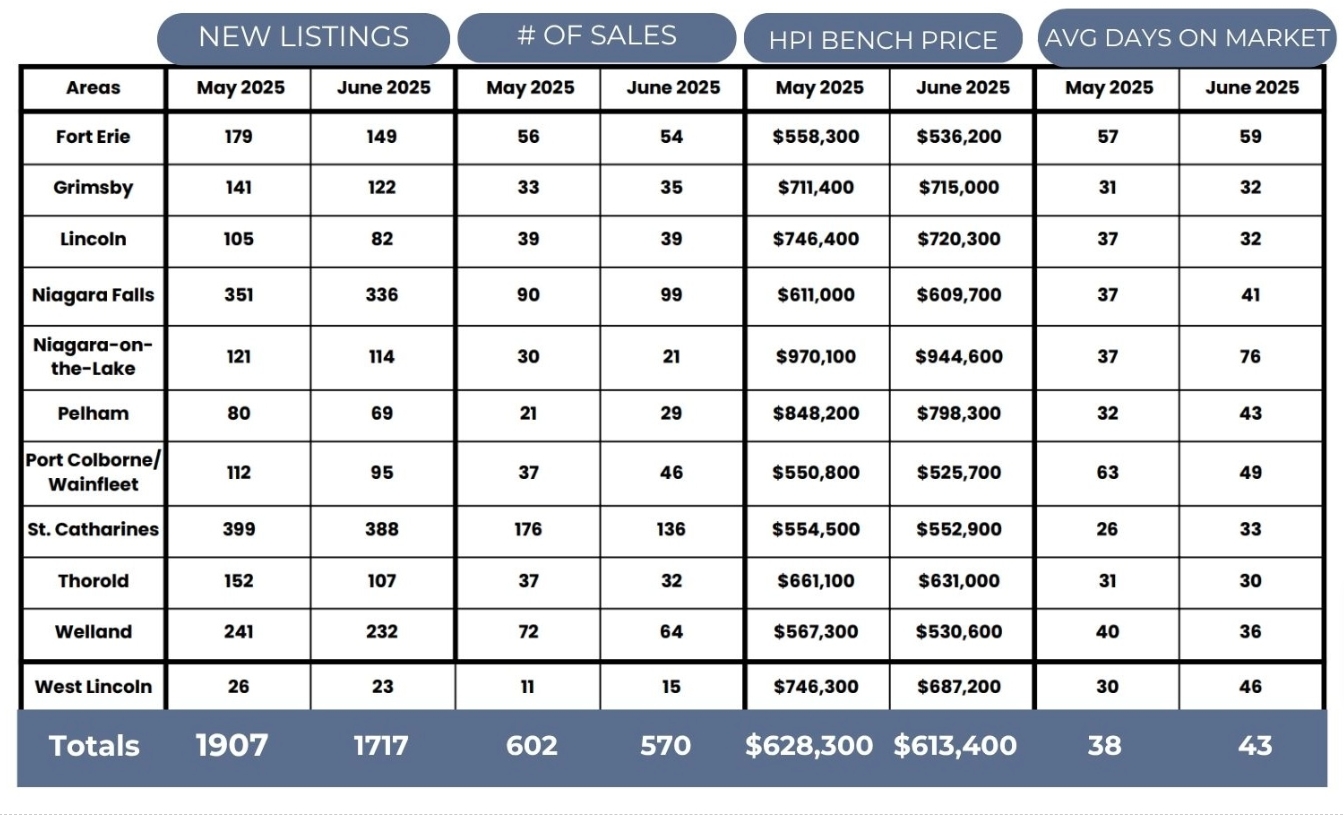

In June, the Niagara Association of REALTORS® listed 1,717 residential properties, down from 1,907 in May 2025. The average time it took to sell a home was 43 days — that’s a 13.2% increase from May.

June’s numbers show that the Niagara market is continuing to adjust. With fewer new listings and softer sales, things stayed fairly steady. The sales-to-new-listings ratio inched up to 33%, which is a small step toward balance, but overall, it’s still a strong buyer’s market.

Homes sitting on the market for 30+ days are starting to see price reductions. On average, we’re seeing about a 2% adjustment across the region as sellers react to current conditions in order to get sold.

We’re seeing this most clearly in St. Catharines, the fastest-moving market in Niagara right now. Inventory there is tighter, and prices stayed mostly flat month-over-month. On the flip side, Niagara-on-the-Lake saw a small bump in inventory and slightly softer prices, giving buyers more room to negotiate.

So, what does this mean moving forward? While interest rates have come down a bit, it hasn’t been enough to get all buyers off the sidelines. With ongoing cost-of-living pressures and economic uncertainty, some are still hesitant to make a move. Typically, July and August are slower months for real estate, but the upcoming Bank of Canada announcement on July 30th might be a game-changer. A rate cut could give buyers more confidence and help take some of the excess inventory off the market.

The key takeaway?

Sellers: price smart, stay flexible, and be realistic.

Buyers: this is still a window of opportunity — if you're pre-approved and ready, you're in a great spot to act fast when the right home pops up.