Posted on

January 7, 2026

by

Megan Sneider

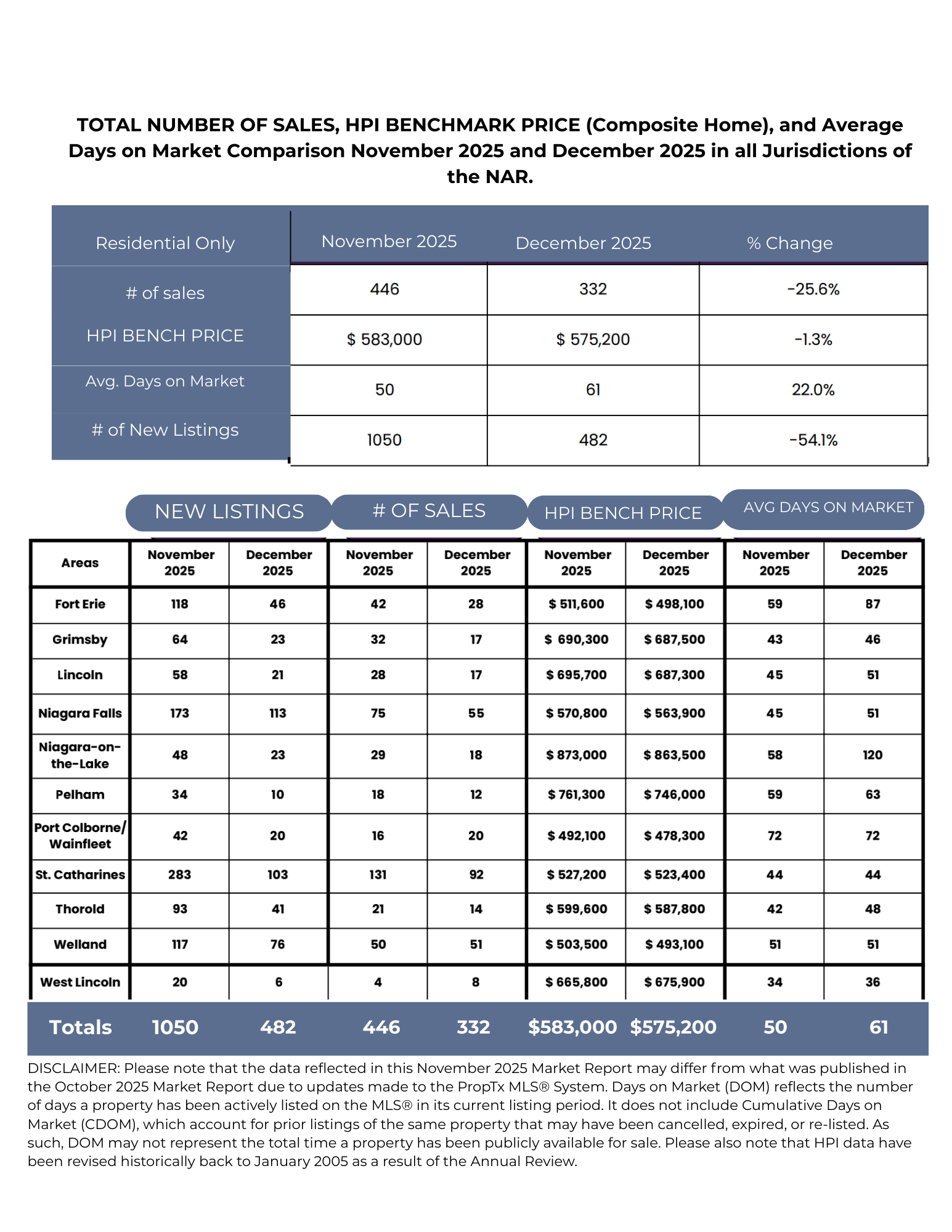

Residential home sales activity recorded through the MLS® for the Niagara Association of REALTORS® (NAR) totaled 332 units in December 2025, compared to 446 in November 2025. In December, the Niagara Association of REALTORS® listed 482 residential properties compared to 1050 in November 2025. The average days it took to sell a home in December 2025 was 61 days, a 22 % increase from November 2025. December’s market activity reflects an anticipated, seasonal transition as we head into what we anticipate will be a dynamic 2026 for the Niagara Region. While we saw the typical year-end dip in new listings, the steady HPI benchmark price of $575,200 demonstrates the underlying strength and lasting value of homeownership in our communities. As we enter the new year, the increase in days on market provides a window of opportunity for buyers to move with confidence, supported by the localized expertise that only a Niagara REALTOR® can provide. As always, obtaining the guidance and support of a local Niagara REALTOR® is the best solution to navigating our ever-changing and sometimes complicated real estate market. The MLS® Home Price Index (HPI) tracks price trends far more accurately than is possible using average or median price measures. The overall MLS® HPI composite benchmark price for the Niagara Region was $575,200 in December 2025. This was a 1.3% decrease from November 2025. The characteristics of the HPI composite benchmark is a home between the ages of 51 to 99 with three bedrooms and two bathrooms. A full list can be found in the accompanying chart.

Disclaimer: Days on Market (DOM) reflects the number of days a property has been actively listed on the MLS® in its current listing period. It does not include Cumulative Days on Market (CDOM), which account for prior listings of the same property that may have been cancelled, expired, or re-listed. As such, DOM may not represent the total time a property has been publicly available for sale. Please also note that HPI data have been revised historically back to January 2005 as a result of the Annual Review.

Will 2026 be a buyer’s market or a seller’s market?

I believe the answer depends far more on strategy than on headlines. In my opinion, 2026 won’t be a “good” or “bad” market, it will be a strategic market. It will reward those who are informed, prepared, and intentional, and it will be unforgiving for those who rely on guesswork.Some buyers will win quietly because they are prepared, decisive, and guided by the right information. At the same time, some sellers will remain frustrated by pricing based on emotion rather than data.

This market rewards buyers and sellers who are positioned correctly. That’s why the better question isn’t “Should I buy or sell in 2026?”, it’s “Am I positioned properly for the market I’m in?” Those who succeed in 2026 will be the ones who understand the landscape early and move forward with clarity and confidence.

Interest Rate Announcements - 2026

The Bank of Canada interest rate schedule for 2026 has been released, and it’s important to understand what these changes could mean for homeowners, buyers, and anyone managing debt.

2026 Dates:

January 20, 2026

March 3, 2026

April 13, 2026

June 2, 2026

July 13, 2026

September 8, 2026

October 27, 2026

December 8, 2026

What Does This Mean?:

For homeowners, now is a great time to review your mortgage strategy and consider locking in fixed rates if rates are expected to rise.

For buyers, pre-approval at current rates can give you leverage and certainty as you search for a home.

For anyone with high-interest debt, rate changes can affect repayments—this could be a good time to explore consolidation or refinancing options.

Key Takeaways:

Impact on Borrowing Costs: Mortgage rates, lines of credit, and other variable-rate products are directly influenced by these moves. This could affect monthly payments, refinancing options, and new home purchases.

Opportunities to Act: Understanding the rate environment early can help you secure the best terms before rates adjust further.